Should you mark the goods you are importing with the country of origin?

Yes, the rules to mark an item with its source country are essential. The international treaties protect these rules.

We have dealt with many problems in trade terms in shipping. Most of these are country of origin marking. We can help you do all this process and determine the source during early trade terms.

In this content, you will know the importance of the country of origin and get information about the process. We will tell you the various national laws on the country of origin. Let’s read!

Country of Origin Definition

The country where you make a product or wholly obtain it is its accurate country of origin. The country of origin is different from where the product sells. A pair of shoes manufactured in China might sell in the United States. The country of origin will be china.

In most cases, the product wholly obtained in one country may have a far better quality than others. Many people prefer to buy products whose country of origin is China. They believe that their quality is higher compared to any other country.

Why is an originating country important?

Here are three reasons:

- Country of origin is an essential factor in the evaluation of products, helping purchasers make informed decisions.

- If you know the country of origin, we can quickly determine the import quotas and duty rates. Trade sanctions and agreements are also easily determined.

- It influences risk evaluation and preferential trade agreements. Therefore, whenever I am shipping or exporting products, I know both the origin and destination country. It IRONS out the complexity of trades. And makes shipping FAST and easy.

How to Determine Country of Origin?

Sometimes the imported final product has duty preference programs or free trade agreements. The land of origin requires details in this situation.

1. Wholly produced or Wholly obtained product

Especially when I am shipping to EUROPE, I mention the production country. It makes the CUSTOMS clearance fast and EASY because of compliance with local rules.

Knowing the product production place or a visible transformation place holds significant importance. Suppose you make a product using Chinese materials and Chinese laborers. You can label it “Made in China.” You need to state if the product uses the labor of foreign origin or imported articles.

You cannot make a “Made in China” claim without saying the required conditions. The Federal Trade Commission can allow the importer to post a conditional claim.

2. De Minimis Rule

The Latin expression meaning “about minimal things” is De Minimis. This rule removes export administration regulations.

The non-originating materials should not exceed from origin rules. These values are 10% or 15 %.

I have applied this rule many times to the suppliers about the 10% to 15% values. They comply with the SHIPPING policy and get the required products with origin of the country.

3. The Rule of Substantial Transformation

The last country of transformation under this rule is the source of origin. The product should have undergone a significant appearance, form, and nature change significantly. If any value is added to the product after production, it falls under this rule.

This rule determines the purpose of origin. This rule applies when the whole creation is from multiple countries. Customs officers interpret the situation under specific trade agreements tariff classification. After interpreting, they can take a final call.

Looking for the Best China Sourcing Agent?

Leeline Sourcing helps you find factories, get competitive prices, follow up production, ensure quality and deliver products to the door.

Rules of Origin

The general rules of origin are preferential and non-preferential. The exact rules may vary depending on the country.

1. Preferential Rules of Origin:

This scheme involves all the trade agreements made between partners. These agreements are about the free trade area. These agreements can be related to their trade interests or any tariff concessions. An easy example of a tariff concession trade agreement is NAFTA, according to its rules.

2. Non-Preferential Rules of Origin:

I have read the NON-PREFERENTIAL RULES of origin. They talk more about the GENERAL APPLICATIONS. And I adhere to them in shipping and exporting products.

Non-preferential rules are for general application. You can determine a product’s origin country using these rules. The product remains compliant with this rule if wholly produced in a single country. You can use other methods for products involving significant imported materials. These rules are for all materials from other countries. These methods are used in determining a substantial transformation.

- Percentage test of value-added

- Tariff classification change

- Specific process tests.

Proof of Origin

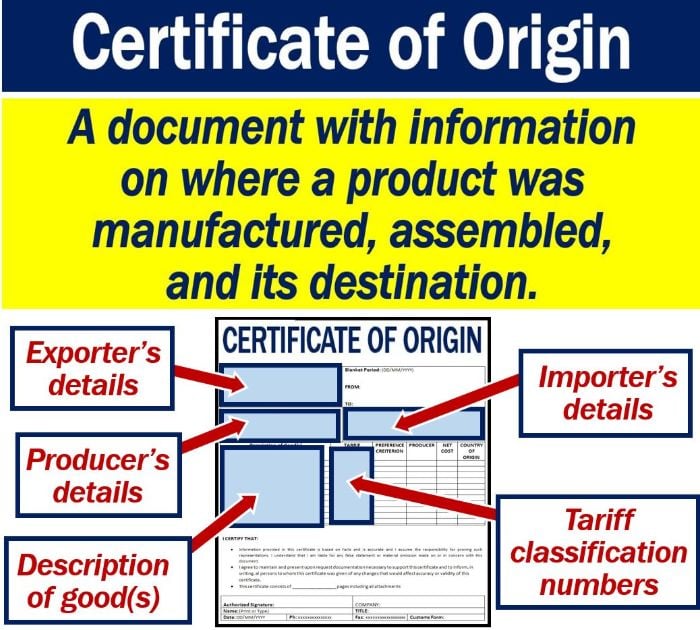

You clarify that certain goods qualify for the rule of preferential tariff treatment. According to US import regulations, importers have to provide a Certificate of Origin. Importers can claim the tariff concessions for goods if they show a valid certificate of origin. Even if exporters are not the producer of goods, they still need to sign and complete the Certificate. The Certificate needs to meet the following criteria:

- The product originating knowledge.

- Faith in the goods stems from written representation by the producer.

The importer must make a declaration to claim preferential treatment on imports. It will be based on a valid certificate of origin possessed by him. It will be when the importer obtains the Certificate of origin for the required good successfully. He must make the preferential tariff treatment request within one year of import.

Suggested reading: China Export Agent

Suggested reading: Alibaba DDP Shipping

Made In vs Country of Origin vs Country of Manufacture

The abbreviation COO (country of origin) refers to the effects on the persona’s evaluations of the country’s brands and products. The basis of these evaluations is perceptions and generalizations. When the goods were manufactured by importers solely in their home country, COO was an easy term. There has been an incredible expansion in manufacturers. The sourcing and global production have also increased. Now COO can have a complex meaning. It is hard to decide the product’s origin early because it is substantially transformed by multinational sources.

Let me make it clear.

Country A can design a product. B can manufacture it by importing country C, D, and E parts. It sells it with a brand now owned by country X. This brand was from country Y. For example, look at the Dell computers’ country of origin. A country where you pack a product, manufacture, or assemble it, is the country of manufacture. Land of origin is the country having the main office and patent registration.

Country of Origin Example

Verifying an accurate country is very crucial. All international trade goods should have markings with their determining country of origin. It would be best if you met some language guidelines for these markings:

- Name in Full English (Except for NAFTA, North American Free Trade Agreement).

- Form of Adjective

- Abbreviations

The marking should always be evident, legible, and easy to read.

The writing has to be permanent and indelible. Additionally, the end customer should be able to see the land of origin marking. For an import process to succeed, you need to adequately determine the country of origin.

FAQs about the Country of Origin

What is a country of origin example?

It is the country of production or manufacture. Purchasing Marlboro tobacco from Malaysia does not change its origin to “Made in Malaysia.”

Can a product have more than one country of origin?

Different methods are used for products that have used materials or are manufactured in other countries. The last country where it has a significant transformation is its country of origin.

Does the country of origin need to be on the packaging?

Under customs regulations and international trade rules, the packaging states the product’s origin.

What’s Next

If you want to ensure that the product complies with CBP import rules and regulations. You should determine the country of origin early. Understanding country origin rules are a critical element. They help decide the top place for making a product, its components, or subcomponents.

If you have issues with anything related to importing goods from China, contact us. We are in contact with thousands of suppliers, so do not hesitate. We will concisely help you.