Do you know how to calculate the costs of goods manufactured? Here is how you can do that.

Cost of goods manufacturing is an essential part of the business. Therefore, tracking these costs is important. That is because it helps see whether the company is making profits or not.

Leeline Sourcing is a pioneer in product manufacturing. Unfortunately, in our experience of over ten years, we have seen many people calculating wrong cost estimations.

Due to that, we have decided to compile a guide that contains information related to COGM.

In this guide, you will learn what COGM is and how you can calculate it. Keep scrolling!

What is Cost of Goods Manufactured (COGM)?

Cost of Goods Manufactured (COGM) is used in managerial accounting. It includes a statement/schedule that shows the total production costs. In addition, it offers the costs involved during the production for a certain amount of time.

COGM includes a variety of costs. For example, there are direct labor expenses and direct materials costs. Then, there is also the production overhead cost of the products.

Why is COGM important?

Nowadays, companies are trying to keep track of total costs. It helps the firms see whether the total production costs are balanced with sales.

One example is the costs of goods manufactured is, a firm has sales of $100,000, and the prices of goods sold are $50,000.

If the company has this kind of information, that will try to lower labor, direct materials, and total manufacturing costs. So COGM gives detailed metrics, and that is why it is crucial.

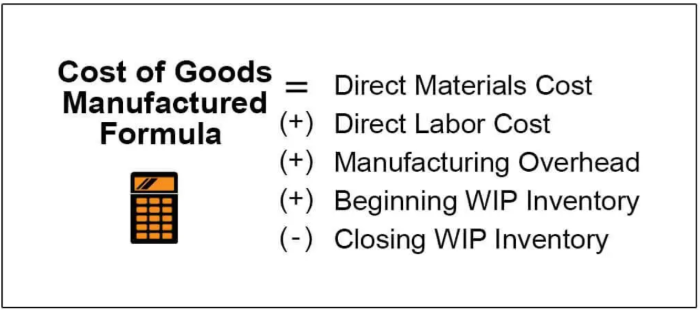

The COGM Formula

Let’s talk about the formula used to calculate the Cost of Goods Manufactured.

COGM= Direct Material costs + Direct Labor + Manufacturing overhead + Beginning Work in Progress (WIP) inventory – Ending Work In progress (WIP) inventory

How to Calculate the Cost of Goods Manufactured (COGM)?

In the above section, we have mentioned the formula for calculating the COGM. But in this chapter, I’ll teach you how to use that formula and calculate your COGM easily. Plus, you will learn the meaning of each metric used in the cost of goods manufactured formula.

1. Direct Materials Costs

Direct materials costs include raw materials pricing. If you want to calculate direct materials costs, here is what you need.

Direct material costs= Starting Raw materials inventory+ Raw materials costs purchased- ending raw materials inventory.

2. Direct Labor Costs

Labor costs are the costs that include the work done by the labor force. To calculate these costs, take the total number of hours. Then, multiply them by the hourly rate.

Direct Labor cost= Total number of hours X hourly wage rate

3. Manufacturing Overhead

Manufacturing/overhead costs include expenses that are not related to production. For instance, the glue used, sandpaper procurement, insurance, and taxes.

Manufacturing overhead= Indirect materials costs + indirect labor expenses + taxes+ insurance

4. Total Manufacturing Costs

All costs mentioned above give the total manufacturing cost

Total Manufacturing cost= Direct Labor + Direct Materials Costs + Manufacturing overhead

5. Starting and Ending WIP Inventory

You also have to take the beginning WIP inventory and ending WIP inventory. WIP inventory is the cost of materials that are not used in production during the accounting period. After these values, you can put all numbers in the goods manufacture formula and move the items to the ending finished goods inventory account.

COGM=Total Manufacturing + Beginning WIP- Ending WIP

Looking for the Best China Sourcing Agent?

Leeline Sourcing helps you find factories, get competitive prices, follow up production, ensure quality and deliver products to the door.

Example

Let’s talk about how you can calculate the cost of goods manufactured by mentioning an example of a furniture company and its production process.

Labor cost is related to technicians, electricians, and workers used. It comes to a total of $135,000

Factory overhead costs of furniture manufacturer include the paper used, the glue used, staplers, stationery, insurance and is totaled to be $150,000

Steel sheets, welding plants, bearings, wires, and terminals come in Direct Material cost and are $150,000.

Then, the beginning WIP inventory (Cost of goods not finished in the accounting period) and ending WIP costs are $35,000 and $45,000, respectively.

Now let’s begin the calculation. Don’t worry. You don’t need to be a math wizard to calculate your COGM. We’ll just use all the values I mentioned above in the costs of goods manufactured formula.

COGM= $135,000 + $150,000 + $35,000+ $150,000 – $45,000

COGM= $425,000

Benefits of COGM

There are plenty of benefits to the costs of goods manufactured. That is because these values give a detailed insight into the business. For instance, it includes manufacturing costs incurred and raw materials used. Moreover, it also includes financial statements, an income statement, goods completed, and what the company spends.

A firm can see whether these costs are going up or down. As a result, managing our expenses related to production is now much easier. It allows me to allocate our budget correctly as well.

But, that is not the only thing COGM has to offer. Some of the other benefits are:

● Enables a business to plan out the pricing strategy

● Provides actual costs related to manufacturing

● Provides a detailed insight into inventory storage and production

● It helps in classifying costs expense recording

● Keeps track of hourly wage rate and total manufacturing cost

COGM vs. COGS

Just like COGM, there is another term used. That is the Cost of Goods Sold (COGS). At first, these two terms seem to be similar. But, they are not the same and shouldn’t be confused with each other.

I’ve been teaching the difference between these two for years now. So if you don’t wanna get confused, just like most of my clients, then read on.

COGS includes making products from raw materials, shipping, storage, and the labor rate. Cost of Goods Sold (COGS) is the expense that is only linked to completed and sold products in the market. It gives a gross profit margin when subtracted from the firm’s revenue.

FAQs about COGM

1. What is cost of goods manufactured in accounting?

Cost of Goods Manufactured is a term used in the accounting category. COGM shows the total cost that is related to an item’s manufacturing. It also includes shifting completed goods to finished goods inventory in the set accounting period.

2. What is included in cost of goods manufactured?

The cost of goods manufactured includes every expense needed for creating a product. For instance, here are some of the expenses that are linked to COGM:

● Direct Manufacture Costs

● Overhead Manufacturing Costs

● Labor Costs

● Beginning WIP inventory account costs

● Ending WIP inventory costs

3. What is Work In Process Inventory (WIP)?

Work in process inventory is a term that is used to refer to the expense of products that are still in production. WIP is usually used at the end of the accounting period or when a new accounting period is starting.

4. What are disadvantages of Costs of Goods Manufacturing?

There are some disadvantages related to the costs of goods manufactured. Some of these downsides are:

● Once a company fixes the expense, it has to make a selected amount of inventory.

● Sometimes wrong costs calculations can affect the profit margins and lead to higher costs.

What’s Next

Costs of Goods Manufactured is a crucial term in the production business. COGM incorporates factors such as labor/material costs. Moreover, it also has WIP inventory and overhead manufacturing costs.

Cost of Goods Manufactured allows the company to plan pricing strategy. In addition, it gives actual expenses related to manufacturing and helps manage inventory.

If you are new to COGM, you can visit our service page for more information.