What is needed to calculate the customs duties when importing items in the USA?. The answer to that is the HTS code system.

Understanding how to pass customs-check in the USA and learning trade terms like HTS will save you from getting into severe consequences. Doing it right will ensure that there are no delays in the shipments.

Leeline Sourcing is a pioneer in product sourcing and, is running services for the past 10+ years. Unfortunately, we have seen many people making such mistakes. However, they avoided those mistakes in time with our help.

This blog will tell you about these codes and how to select the correct code to avoid any trouble.

What is an HTS Code?

HTS code stands for Harmonized Tariff Schedule. It is a method that lets you classify items. The classification gets used by US customs and International Trade Commission. In simple words, HTS codes are ten-digit codes given to imported products. And that helps it in identifying the product parameters.

Harmonized Tariff codes provide a detailed insight into the tax and customs. For example, importers have to pay import duties to bring the product into the country. Plus, it also shows whether there are any restrictions on the product or not.

Why does choosing the right HTS code matter?

There are various reasons why you have to select the right HTS. On the other hand, choosing the wrong HTS codes will lead you to severe consequences.

1. Determines the customs charges.

HTS coding system allows the customs officials to determine the customs taxes on the product. For example, suppose there is an HTS number of 9506.62.80. This code is for inflatable balls. The code specifies a 4.8 percent import duty if someone imports this item.

Important Tip! I always check the HTS CODE correctly. Every product has different fees. Check before you pay.

2. HTS doesn’t work in other countries.

I know the CODING SYSTEMS for the products are different in different countries. Therefore, you should take note of it and pay the customs accordingly.

HTS code is only designed to work in the United States. There is a slight difference between HTSUS and other codes. Ensure that you are not using HTS code when importing items to Non-US countries. For instance, If you are importing inflatable balls in China, the code for that is 9506.62.1000, while in the US, that code is 9506.62.80.

3. Importers’ obligation.

Lastly, selecting the correct HTS code is that the importer must file for taxes. If he picks the wrong HTS code and misclassifies the goods, that can cause serious problems.

How to determine your HTS code?

Harmonized system codes describe items to the molecular level. The HS code system helps CBP in classifying import items. However, they do become a nightmare for shippers when categorizing their items.

This chapter will explain what the digits represent and how to determine the correct HTS code.

Step 1: Understand your product

I keep an eye on the product at first. Then I found the HTS code according to the legal sources. And finally pay the customs fees.

Before allotting HS and HTS codes, it is essential to know your product. Understand what it is made of, what it does, and any other details.

Step 2: Start chapter wise

The HS classification codes will seem straightforward if you go chapter-wise. Start with selecting the right chapter for your products. Then, go from section to section.

Step 3: Read notes

Make sure that you read the notes given at the start of each chapter. Those notes will provide you with guidance related to your product.

Step 4: Use the HTS Search Tool

The International Trade Commission’s official website contains the entire HTS list.

After I have identified the chapter referring to your product, download the PDF of that chapter. Do research and find the ACCURATE number.

After that, narrow down the search by entering the words that match your product in the search engine.

Step 5: Compare and select

There can be different HTS codes related to the same product. Compare each code heading and select the one that describes your product.

Step 6: General Rules of Interpretation (GRIs)

There are 6 GRI for classifying the items accordingly. You can find these rules on the ITC website. They cover things like classification applies to finished and unfinished products, etc.

What I do:

- Open Google.

- Open the ITC website.

- Check the GRI category.

- Classify my item accordingly.

Step 7: Ask an expert or request legally binding rulings

If you can still not classify your items, you can contact US commercial service. Or better, you can ask the CBP (Customs and Border Protection) to issue a ruling letter on how to identify your items.

A Fast , Easy and Cheap Way to Ship from China

Do not hesitate to contact Leeline Sourcing at any time regarding your shipments from China.

How do HTS code work?

The use of the HTS system is to classify the goods imported into the US. The latest version of HTS is available on ITC’s website. It contains over 99 chapters and 22 sections, classifying different goods.

HTS catalog consists of GRIs, General Notes, trade statistics, and extra guidelines. These together will let you classify goods in the form of a code.

The whole HS directory contains sections, chapters, and subchapters. For instance, selecting section II and chapter 7 will give codes related to vegetables, roots, and tubers.

Once you have these codes, you can calculate the customs the government will take from you. Plus, you can also check whether the goods are banned in the US or not.

Suggested reading: Alibaba DDP Shipping

Structure of HTS code

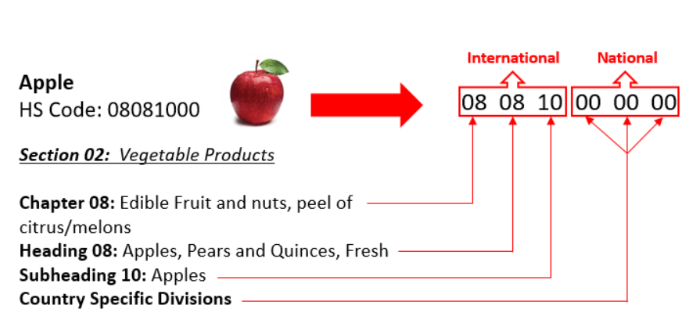

Moving towards the structure of the HTS, it is a 10-digit long number. The number has five different parts. Each of these parts provides a piece of information used to identify a chapter, heading, or preferential tariff.

In the structure of the HTS code, the first six digits are part of the HS code. Rest represent HTS coding system and are for US only.

Chapter: The first two digits in the HTS identify the chapter. They remain the same internationally. Meaning the HS code will have the same digits.

Heading: The next digits in the HTS coding show the chapter within that chapter. They also remain the same for HS codes.

Secondary Heading: After heading digits, the following two numbers identify the secondary heading under that heading. They are also used in HS code structure.

Tariff Rate lines: The next two digits are only for HTS (US) code. They give details related to duties and taxes.

Statistical data: The last two remaining digits in the HTS coding system represent the trade data. These are also limited to the United States only. The last four digits also represent country-specific categorizations.

HTS Code vs. Schedule B vs. HS Code

Currently, three different code schemes are used for classifying a product:

● First, there is the HTS code.

● Then, there is the HS number code.

● Lastly, there are Schedule B codes

Let’s discuss the difference between each coding scheme and see how they work.

HTS Code:

First, there is the HTS code. It helps in classifying goods that get imported into the US. Remember, the HTS is only for the US. You cannot use it in any other country.

HTS comes in a 10-digit format. It contains information on the chapter, heading, subheading, tariff, and statistical trade data For the US only.

Harmonized System (HS) Code:

HS code or also known as Harmonized system code is a number that is used to classify products on international borders. In simple words, it is a six-digit number that shows the chapter, heading, and subheading. HS codes work internationally and provides further classifications for every type of product.

I often remain CONFUSED between the HTS and HS code. It is for the INTERNATIONAL shipments and imports compared to the HTS specific for the US.

Schedule B Number:

Harmonized Tariff Schedule (HTS) is for goods imported into the United States. Schedule b codes are used to identify the goods exported out of the United States. Schedule b code also has 10 digits and shows information related to export tax, etc.

How to avoid HTS code issues?

Selecting the wrong HTS for imported goods can result in various issues. For instance, it can lead to overpayment/underpayment of taxes. If you select the wrong HTS, it can send a red flag to US customs. And they will penalize you.

A year ago, the same thing happened with me! I input the wrong HTS code. US customs asked me to pay the FINE and customs fees.

Factors like these make it important to take precautions and do proper classification. It will help you stay away from customs issues. Here is how an importing country can avoid problems that come with Harmonized Tariff codes.

Who provides the HTS code?

Figuring out who is responsible for providing HTS codes is an important step. That will help you stay away from issues because you will know who is responsible. For example, ECommerce companies select harmonized Tariff codes because they are the ones importing products. Moreover, sometimes a freight forwarder can also arrange these codes.

If you are ordering a product from Alibaba, the supplier will provide you with the HTS. Customs will use that code for calculating the duties and providing you with commercial invoices.

Select the right HTS code

The World Customs Organization (WCO) website lists codes that cover almost every product. To get the lower duty rates, companies select the wrong code. Or, if they cannot find the exact code, they tend to go for a code that somewhat matches the product. That is wrong and can lead to penalties or overpayment/underpayment.

You can avoid that risk by selecting the correct code. Or, if you cannot find the code, you can always ask the experts, like LeelineSourcing.

Looking for the Best China Sourcing Agent?

Leeline Sourcing helps you find factories, get competitive prices, follow up production, ensure quality and deliver products to the door.

HTS Code Example

Harmonized system enables US border protection to classify the product and calculate taxes for the product. But how do they do that? In this chapter, we will explain the interpretation by giving an example.

Suppose this is an HTS: 0902.10.90.15.

Let’s break down the code using the interpretation technique

● 0902.10.90.15 in the code refers to chapter 9 of the code list. This code list covers Coffee, Tea, and other spices

● 0902.10.90.15 is heading number 2, and it covers the tea, flavored or unflavored.

● 0902.10.90.15 in the code is subheading 10, referring to green tea.

● 0902.10.90.15 gives the tariff rate of the flavored item

● 0902.10.90.15 is the statistical suffix. It suffix shows that green tea is certified organic.

FAQs about HTS Code

What are HTS Codes Functions?

HTS code functions are a method that helps customs officers identify items that are being imported. Customs can classify a good and apply relevant taxes on it with these codes. Moreover, they also check whether the item is banned or not.

Can the HTS number be used to classify exports?

No, you cannot use HTS to classify goods that are being imported. Instead, the export classification systems use schedule b codes. Schedule B code allows officials to check duties on items exported from the US. Like HTS, a Schedule B number also contain 10 digits.

Where can I find the HTS number for my good?

The World Customs Organization website contains the HTS list for all items imported into the USA. That is where you can find the code related to your product.

Can I use HTS codes with Shopify?

Currently, Shopify does not support HTS codes. However, you can use HS codes. Take the first six digits from your HTS code and put them in. Those six digits are HS codes and give information about products. Make sure you are putting the right HS code.

How do you read HTS codes?

HTS has five different parts. You can read those parts in this way.

● The first two digits show the chapter number.

● The second two digits show the heading number.

● The following two digits indicate the sub-heading number.

● The next two digits are tariffs.

● The last two digits are the statistical suffix.

What’s Next

Understanding the HTS is essential if you import items in the United States. It will help you in classifying items when bringing them into the country. HTS gives information such as duties/customs charges and restrictions. Incorrect classification of goods can lead to severe consequences li. So, make sure you are doing that step accurately to avoid misuse of free trade agreements, international trade scams, etc.

Sometimes, selecting the correct harmonized tariff code requires the guidance of an expert like Leeline Sourcing. If you need us to find the right HS or HTS code, don’t hesitate to contact us.