What is the detail of FBA Fee you should know when Selling on Amazon?

FBA fees directly affect your profit margin, marketing strategy, and outsourcing Price.

Our FBA experts have done many pricing case studies. Read this Expert article to understand the fee structure of AMAZON FBA Prep services. Ultimately take pricing decisions to make it a viable product for you and your customer.

Keep reading to learn about DIFFERENT types of fees in the FBA business.

1.FBA Inventory Placement Service Fees

New accounts will most likely be assigned to different Amazon warehouses when FBA shipments created. To deliver goods to a fixed warehouse address, you need to set up the inventory placement service by a backstage operation. Of course, the inventory placement service will also be charged. Request your shipping agent to deliver goods on time with visible barcodes. In case of any mistake, processing and placing your inventory takes extra days.

Rate:( per piece)

After the FBA shipment created, close the inventory placement service in time. Open the service again when needed. Compared to the high cost of shipping goods to different warehouses, it can save a lot of costs to set up inventory placement service.

Suggested reading: FBA Shipping From China to Amazon

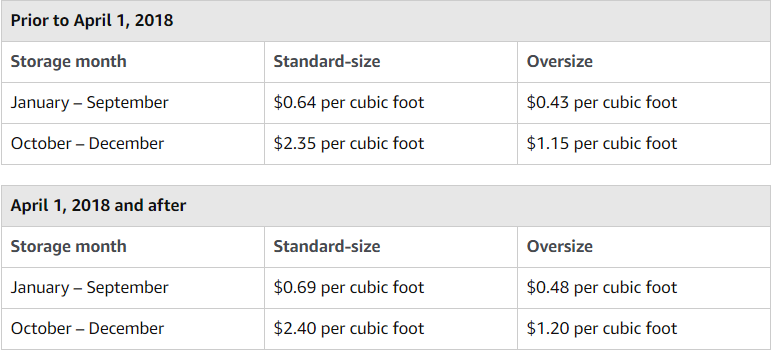

2.FBA Storage Fee

FBA storage fees include Monthly Inventory Storage Fees, Long-Term Storage Fees, Minimum Long-Term Storage Fees. Also, Storage fees change every quarter and season. In the last quarter, they skyrocket. I keep my excessive stock in third-party dark storage houses. When inventory is low, ship a certain amount to the FBA warehouse.

The monthly storage fee will be charged start 7th to 15th of the next month.

Rate: (per cubic foot)

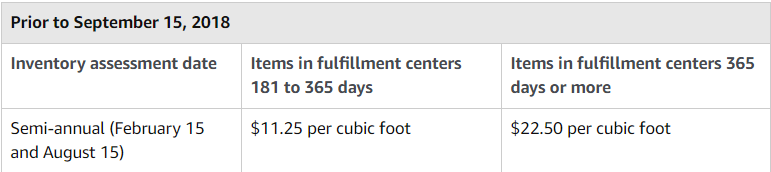

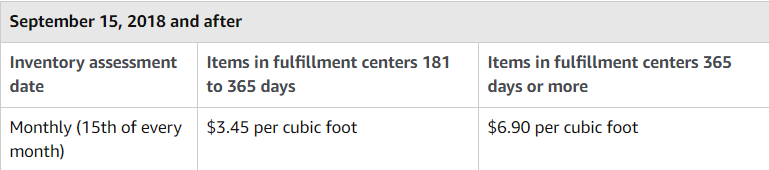

3.FBA long-term storage fees

In the past, FBA would count once every year on February 15 and August 15.

Do you think it will be half a year after the long-term storage fee is calculated on August 15? No, starting September 15, Amazon begins calculating long-term storage fees on the 15th of each month.

The following is the specific charging standards.

On August 15, 2018, Amazon will introduce a minimum charge of $0.50 per unit per month for items in fulfillment centers for 365 days or more. The greater of the applicable total long-term storage fee or the minimum long-term storage fee will be charged.

Storage fees get updated every year, so now it may be changed. My supplier chooses light and compact boxes and packaging solutions. I use light cushioning material to lower dimensional weight. Compact and small packages take less space & less expensive storage space.

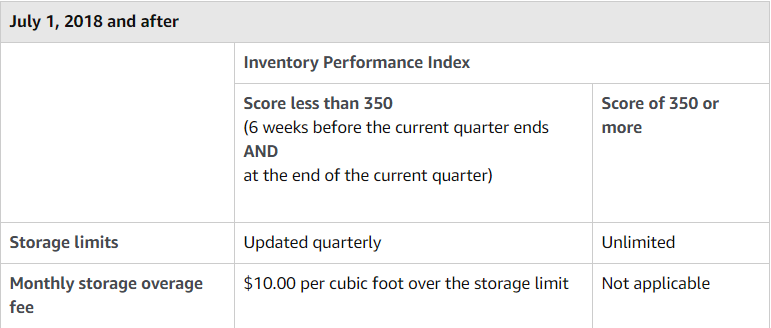

This is not the end of the story. Beginning July 1, 2018, Amazon limit access to storage for sellers with an Inventory Performance Index below 350.

4.Inventory Storage Overage Fee

Storage limits are evaluated every 3 months for factors such as: 1) your sales volume, 2) your historical Inventory Performance Index scores, and 3) available fulfillment center capacity.

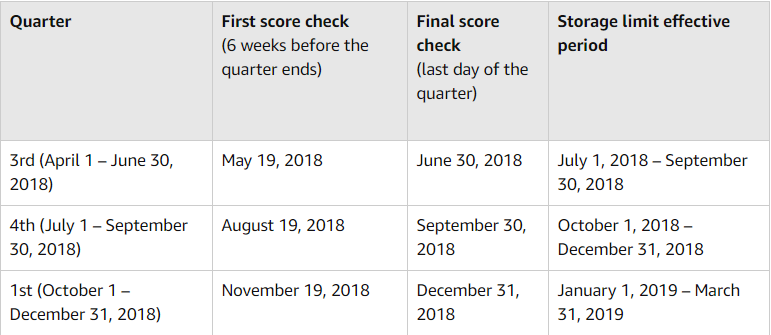

Storage limits are determined based on your Inventory Performance Index on two dates during the quarter: 1) Six weeks before the end of the quarter; and 2) the final day of the quarter. The effective dates for the associated storage limits:

The effective dates for the associated storage limits:

Be sure to check your inventory limits in the background. The charges can be quite staggering if limits are exceeded. Starters have a low inventory limit, as Amazon has no sales data. When you get good sales, Amazon increases your inventory limit. The algorithm also helps you to increase listing ranks too.

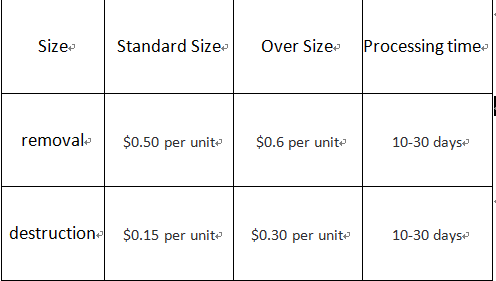

5.Cost of removal and destruction of product

If your FBA inventory is large, you will incur large amounts of storage costs. Consider clearing the goods by various means including promotion, removal, disposal, etc. Of course, removal and disposal will be charged.

The expenses are as follows:

Amazon usually destruct your damaged inventory. It’s better to discard them than repair or receive them. You save time and costs and invest in business expansion.

In conclusion, use the FBA fulfillment, in addition to normal FBA delivery processing fees, it could happen FBA Inventory Placement Service Fees, FBA monthly inventory storage fee, FBA long-term storage charges, FBA minimum long-term storage fee, Inventory storage overage fee, removal and disposal fee.

So at the start of any project, make sure you carefully assess costs, make good coping strategies, and reduce the project risks.

If you have any other questions or need some help in selling or sourcing products in China, please don’t hesitate to contact us. We are the best sourcing Agent Company in China you can trust.