American sales tax once became a hot topic discussed among cross-border e-commerce sellers.

Today, Leelinesourcing discusses the questions about the American Amazon sales tax and answers them for you.

The U.S. consumption tax is a tax levied by the federal government and state governments on some goods.

US consumption tax is divided into federal consumption tax and State sales tax.

- 1. Which sellers does the Amazon auto-mall tax apply to?

- 2.When and where will Amazon automatically calculate, collect and pay on behalf sales tax?

- 3. How does Amazon determine the taxability of goods?

- 4. Do I need to do anything?

- 5. Will the seller receive a regular statement of sales tax from Amazon?

- 6. What reports do sellers have that they can ask about taxes? How do they identify sales taxes Amazon collects?

Let’s take a look at what Amazon’s official explanation of sales tax is:

1. Which sellers does the Amazon auto-mall tax apply to?

All sellers of goods sold in Amazon.com mall.

2.When and where will Amazon automatically calculate, collect and pay on behalf sales tax?

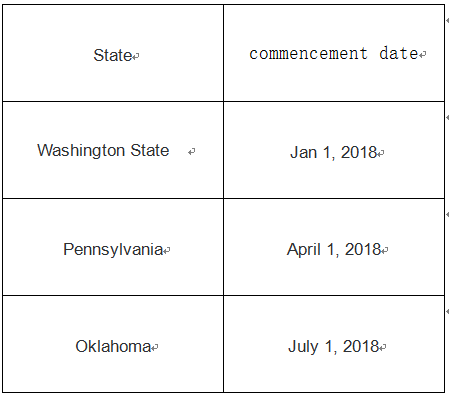

Under applicable State tax regulations, Amazon will begin calculating, collecting and paying sales tax for buyer orders shipped to the following states from the effective date.

3. How does Amazon determine the taxability of goods?

For orders subject to the applicable mall levy, Amazon will use set categories and quote the details you provide. It can also choose when setting the quote to determine the taxability of the item.

4. Do I need to do anything?

You do not need to do anything with your seller account or Tax Settings. If you have questions about your company’s obligations in a State where Amazon automatically calculates, collects, and pays sales taxes, it is best to consult a tax advisor or consult resources associated with the state for details.

5. Will the seller receive a regular statement of sales tax from Amazon?

The taxes charged on your order through mall taxes will be included in the existing order, delivery, payment, and sales tax report options in your account.

6. What reports do sellers have that they can ask about taxes? How do they identify sales taxes Amazon collects?

For individual order details, go to the order details or transaction details page. When the [tax mode] is the [service provider] and the [responsible party] is [Amazon], it means that Amazon will automatically collect sales tax.

For detailed information on multiple orders, information from the mall provider is displayed in the date range report, order report, and sales tax report.

To determine when an order execution mall is taxed, check the information in the following specific report.

1. Date range report

The 【sales tax 】column shows the amount of tax collected.

The 【mall services tax】 column shows how much Amazon will deduct from the proceeds of the order and pay to the States concerned.

If an amount is shown in the 【sales tax】 column but is not shown in the 【mall services tax】 column, Amazon does not automatically calculate sales tax for the order.

2. Order report and sales tax report

If the sales tax is calculated, collected and paid by Amazon for your order, the 【tax mode】column will be displayed as the 【mall provider】.

If the taxes are calculated by Amazon, the 【responsible party】 column will show as 【Amazon】.

Note: If the above columns are not displayed in your order report, you can manually add them by clicking on [add or remove order report columns]. See the order report for more information.

3. Can I opt out of automatic taxation?

NO. You cannot opt out at this time.

4. Can I stop Amazon shipping to States where it’s automatically taxed?

NO. Amazon does not currently support restrictions on the sale of goods to certain states for tax reasons.

5. If a State is automatically calculated, collected, and paid for by Amazon, can I edit the state’s tax calculation Settings?

You do not need to update your Settings for States that automatically calculate, collect, and pay sales taxes by Amazon. The system will use your tax calculation Settings for items that are not automatically collected by Amazon or are excluded.

6. Who is responsible for processing a buyer’s tax-only refund application for an order?

The seller is responsible for processing refund applications related to the following orders:

1) The seller’s self-delivery orders of using your tax calculation Settings to calculate the tax.

2) See how to tax refund on the help page for more information.

The Amazon customer service team will process refund applications related to the following orders:

1) All orders automatically calculated, collected and paid by Amazon for your order. All amazon logistics (FBA) orders.

I hope you’re not lost have read all these. If you’re, don’t worry. Let me sum it up and make it simple to understand.

While Chinese sellers on Amazon in the United States don’t have to pay sales tax on their own, it is better to know the applicable policies.

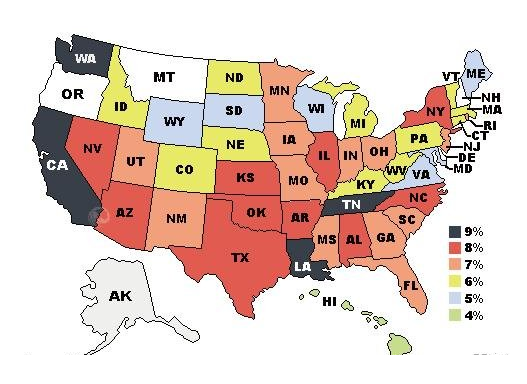

A Consumer tax is a tax levied by the U.S. government on Consumer goods. There are differences in the Consumer tax rates among the different States, as shown in the following figure:

Don’t forget that the United States has five tax-exempt states: Oregon, Delaware, Alaska, Montana and New Hampshire.

There are also states that are partially exempt (which are exempt depending on the type of goods):

1)The duty-free states for clothing goods include New Jersey, New York, Minnesota, and Pennsylvania.

2)The duty-free states for Non-prescription drugs (nutritional supplements, such as vitamins) include New York, Texas, Virginia, and Pennsylvania.

All in all, the Consumer tax of Amazon America station is automatically calculated, collected and paid by the Amazon system. There is no need for Chinese sellers on Amazon in the United States to do any operation. Amazon has already done all the work for you.

For more details, please consult Leelinesourcing, we will try our best to help you.